Contents:

When the pattern breaks down, the ensuing price movement is rapid, with volatility, and volume increasing in harmony. A consolidation pattern, or a sideways trend occurs when the price settles into a relatively tight range between a support and a resistance level, and remains there for a long time. A true consolidation pattern usually lasts more than ten bars at the very least, but as with all rules in technical analysis, it is possible to identify consolidation phases that last much shorter.

- Quantifying this bottom line is relatively new, problematic and often subjective.

- While that would have the benefit of having a common unit—dollars—many object to putting a dollar value on wetlands or endangered species on strictly philosophical grounds.

- It’s rare since the successive creation of three equal lows doesn’t happen quite often.

- An important point to remember is that the trend line is drawn above the price action in a downtrend, and it is drawn below the price action in an uptrend.

In the case of the upward v-reversal pattern, the first leg represents a panic phase. But due to the dual nature of all trades in the currency markets, however, the panic phase corresponds to a bubble phase for those who are on the opposite side of this trade. Finally, this pattern may be interpreted differently depending on the underlying price action that precedes and follows it. For example, a reversal pattern following a consolidation or continuation pattern may not present the same technical picture as that created by a v-reversal pattern that comes after a long lasting, and powerful trend. In general, the longer, and more powerful the preceding period, the more credible a sharp and fast v-reversal pattern is.

Analyzing the Triple Top Pattern

Benzinga provides timely, actionable ideas that help users navigate even the most uncertain and volatile markets – in real-time with an unmatched caliber. And lastly, it helps in signaling a shift in supply and demand of a stock. However, the lower price increases demand, and the buyers pushed the stock higher, resulting to the final uptrend. We also know that during a Triple Top, price action bumps off resistance, posting three equal highs before going down through resistance.

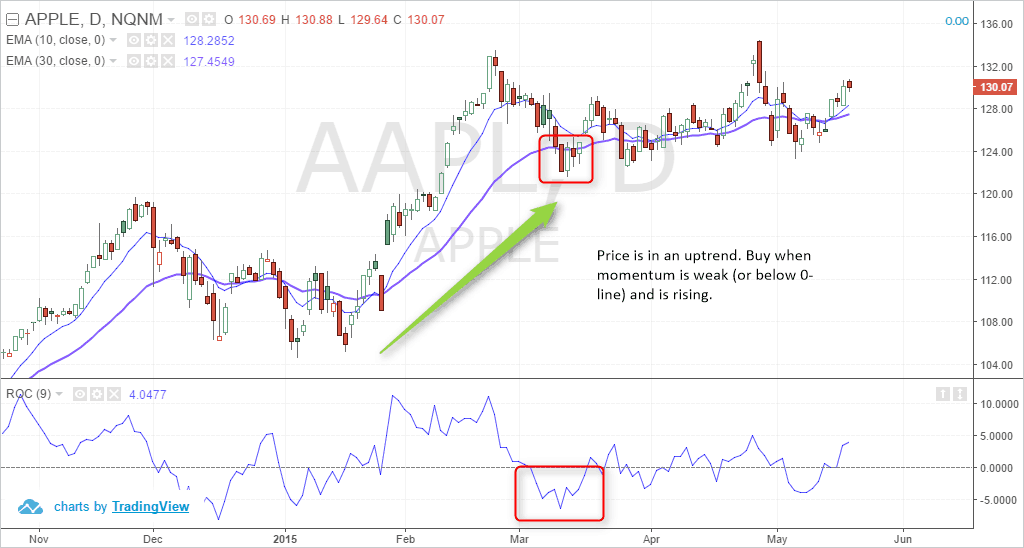

Hence, we set our entry as soon as the https://forexarena.net/ candle closes above the neckline. The vertical blue, which measures the distance between the support and neckline, will help us determine the take profit. Looking at the chart above, a 4-hour chart, we see a strong breakout that launches the price action higher. As this breakout candle closes much higher, leaving us without an opportunity to dip into the market, we move to a 1-hour chart to identify our entry. Three consecutive failed attempts to break lower usually stick out on the chart . The outcome of the second attempt is the same, which now makes this level extremely important as the sellers, who are still in control of the price action, have now failed for the second time.

Terms

I/we have a beneficial long position in the shares of OUNZ, GLD either through stock ownership, options, or other derivatives. One could argue that the final gold bottom in 2001 was also a triple bottom, but that’s a judgment call. We offered to pay the cost for a full truck load “Fee” for that small quantity….they just thought its a waste of their time and our time!! It is a different story we had the luxury of time to convince that vendor as some one else paid for our time!! In the startup journey, we are struggling to ensure we follow the same principle!!

Access to “information” within the context of our journals, SciFinder and other products of the Chemical Abstract Service, and technical meetings/conferences were always high on the list. But it has been interesting to note that “opportunities to network” is toward the topped the list, as well. Get Started Learn how you can make more money with IBD’s investing tools, top-performing stock lists, and educational content. IBD Videos Get market updates, educational videos, webinars, and stock analysis. To address financial bottom line profitability concerns, some argue that focusing on the TBL will indeed increase profit for the shareholders in the long run.

Upward Head and Shoulders

After all, you cannot have a bottom if you are in the middle or top of a formation. The premise of a multiple bottom is that the stock has already suffered a serious decline, and a buying opportunity has been forming for a while at a lower price. Which note value gets the beat (e.g., the quarter note in 4/4 or the dotted quarter note in 6/8). Breaking the eighth note into two sixteenth notes connected by a tie, as shown in the second measure, clearly shows the beginning of beat 2. When notes last longer than one beat , the count is held over multiple beats.

The vertical count method was used to find a price objective of 44, which missed the bottom by one box. The most recent pattern is a Descending Triple Bottom Breakdown with a downside price objective of 65. Breakouts are not predicted, but confirmed by indicators such as the Bollinger band, as volatility increases, bullish or bearish crossovers occur, range patterns break down, and the price begins a rapid movement to either side. While it may be possible to anticipate that a breakout will occur, in the absence of special situations like divergences, it is very difficult to anticipate the direction of the breakout. For example, on a day with an important news release, everyone knows that a breakout is highly likely at around 8 am New York time, but few can be confident about the direction.

Our every act during our transactions in our daily lives, can and should be driven by the QBL and every action should be measured against the four metrics to ascertain sustainability. Metric based evaluation of the four P’s ensures that the organisation has a sustainable growth. This also ensures a sustainable business is also an extremely ethically purposeful business which in turn ensures longevity. The Triple Bottom Line concept was advocated in the 1980s and articulated for the first time in 1994 by John Elkington.

My YouTube Video on Triple Bottom Pattern Recent Examples

Not only does the pennant develop in a very tight range by nature, but all the counter trend gains registered during its brief life are usually erased on the first movement of the price that negates the pennant. Pennants develop even faster during a down trending market, as market actors try to close their positions and minimize profits as fast as they can. But in all cases, the pennant is brief, swift, and relatively insignificant.

The rising summer temperatures and extremely short yet harsh winters being witnessed in recent years. The flash floods in the USA, the Mega Cyclone which hit the UK recently, the bushfires in Australia that killed an estimated 1 billion animals are indicative of a changing weather pattern. The thinning of the Antarctic ice shelf is leading to rising ocean levels. The rising of the ocean temperatures are leading to erratic marine life growth. All of these can be directly attributed to our usage of fossil fuels and not achieving SDG targets as nations, and as industry. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice.

- The concept of TBL demands that a company’s responsibility lies with stakeholders rather than shareholders.

- Still, the second and third bottoms show a change in direction where buyers may push the price action higher after the price breaks through the resistance.

- Instead of a bullish reversal, a triple top is a bearish reversal pattern where price action bumps off resistance three times, posting three roughly equal highs before plummeting down through resistance.

- The first two occurred after Triple Bottom Breakdowns , which makes then continuation patterns.

These https://trading-market.org/ patterns occur in the forex, futures and stock markets, across all time frames. There’s no method which can create constantly profitable results, but there are a few principles that will help you reduce the risk of a false trade. Most traders won’t trade a range unless it is confirmed with at least one candlestick in the direction of the anticipated reversal at the support or resistance lines.

QBL, ESG and SUSTAINABLE STRATEGY

Still, in this text we’ll examine the true consolidation pattern which lasts long, reduces volatility significantly, and is confined between a support and resistance level. In this four-hour chart of the GBPUSD pair, we note a very sharp spike which takes the price from around 1.38 up beyond 1.45 in about a day. The first attempt to breach the major support line at 1.445 is successful, and the price manages to hold on to this previous resistance line as a support during the ensuing countertrend movement. However, the brief but large momentum of the trade is exhausted already, even as the price holds above the newly created support line during the many attempts to breach it by sellers which last for more than a week. Eventually, we see a somewhat difficult to identify head and shoulders pattern developing, with the reversal breaking the support line, and sending the price down.

Cathie Wood’s Ark Invest says Tesla stock will more than quadruple in price by 2026 if it can deliver a networ – Business Insider India

Cathie Wood’s Ark Invest says Tesla stock will more than quadruple in price by 2026 if it can deliver a networ.

Posted: Tue, 19 Apr 2022 07:00:00 GMT [source]

On a long https://forexaggregator.com/ chart, such a situation is usually accompanied by declarations of a new era by the news media and some analysts. When such a bubble like situation develops on the hourly charts, it is only noted by traders, but the nature of the price action is the same. As with all continuation patterns, the descending triangle will cause volatility to decrease, as the indicators settle to relatively subdued levels, and money flows through.

If the final break was too low for that qualification, it only makes the illusive triple bottom even rarer. In any case, after that final bottom in 2018, gold never came close to $1,200 again, nor do I think it ever will. But more to the point, the lower low in gold stocks was simply not confirmed by the metal. Granted, with chart patterns like these, there is always a bit of wiggle room with definitions. That said, by what I can find, if gold has indeed bottomed in the mid $1,670s then this would be only the fourth or fifth triple gold bottom in 42 years. Doubtless someone can probably go through the charts with a fine-toothed comb and possibly find more, but the point is it is a rare pattern unlike the more common double bottom, and relatively hard to find.

Comente